The accounting records will show the following bookkeeping entries for the drawings accounting. You will have one capital account and one withdrawal or drawing account for each partner. Here we discuss the meaning of drawing account examples drawing account journal entry and its accounting treatment.

drawings accounting journal entry

The journal entry closing the drawing account requires a credit to eves drawing.

Drawings accounting journal entry. In case of cash withdrawn for personal use from in hand cash or the official bank account. Accounting and journal entry for loan taken from a bank. And at the end of the period close this drawing account by crediting it to the respective partners capital account. Journal entry for drawings accounting.

Journal entry will be drawings ac dr to cash ac being cash withdrawn from the company if he utilize the goods from the company for his personal use the journal entry will be drawings ac dr to goods ac being the goods used for his personal. Drawings of stock implies stock or goods taken away by the proprietor or partner for personal purposes. Recording journal entry drawings of stock is also an accounting transaction and has to be brought into the books of accounts through a journal entry. Guide to drawing accounting.

For a fuller explanation of partnership journal entries view our tutorials on partnership formation partnership income distribution and partnership liquidation. A drawing account is an accounting record maintained to track money withdrawn from a business by its owners. For the earlier simpler lesson on this transaction without the journal entry where we just go over which accounts are affected and what the effect on the accounting equation is see the first lesson on the drawings example. What are drawings and its journal entry cash goods.

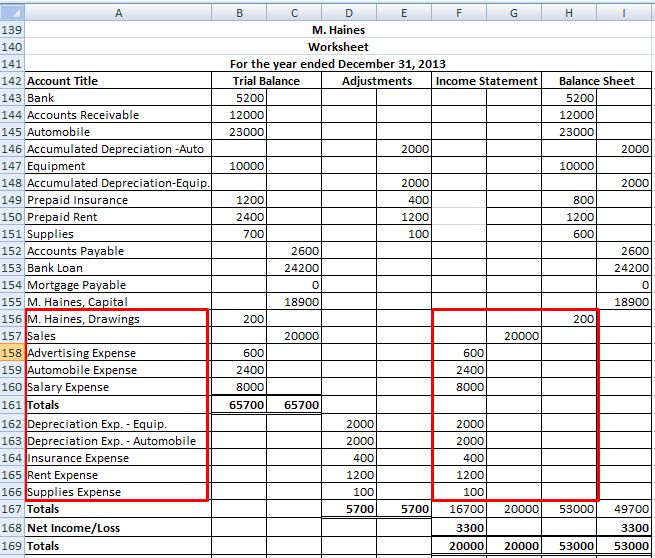

If for example an owner takes 200 cash from the business for their own use then the drawings accounting would be as follows. The partnership journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting relating to partnerships. By drawing account partner to bankcashgoods account. Journal entry for drawings of goods or cash.

The bookkeeping entries are recorded on the drawings account. You may also take a look at some useful articles. The journal entry for drawings for partners is. Guide to drawing accounting.

Here we discuss the meaning of drawing account examples drawing account journal entry and its accounting treatment.

/153221908-5bfc2b8c4cedfd0026c118f2.jpg)